This summer the Robert S. Strauss Center for International Security and Law is thrilled to be funding seven Crook Fellows, who will be interning at non-profit organizations devoted to development work all over the globe. The fellows will be blogging about their experiences in the field over the next few months, so be sure to check back for more posts.

Annie DuPre is interning with the Economic Policy Research Institute in Cape Town, South Africa. Her internship duties include contributing quantitative analysis as well as research and policy recommendations for issues of social protection and poverty reduction throughout South Africa. Her first blog post is below.

A Look at Health Microinsurance

Microfinance has become increasingly well known throughout the world as a way to provide low cost or free loans to individuals and families living in poverty. Less well known, but increasingly important, is the market for microinsurance. There are many kinds of microinsurance – from life to agricultural – but for this post I will focus on health microinsurance (HMI), which has been used to deliver affordable medical care to at-risk and vulnerable populations throughout the world.

In general health insurance is very important for preventative, regular, and reactionary medical care. Yet those who are disproportionately vulnerable to illness and the compounding costs of medical care – low- and middle-income individuals and families – are often left out of the insurance marketplace. This exclusion is due to a number of factors.

On the demand side, poor individuals may not see the benefits of paying premiums (when there is no immediate health issue), cannot afford the cost, are not educated as to the purpose of HMI, are socially or culturally averse to the idea of insurance, or live too far from healthcare services to benefit from HMI. On the supply side, providers are often unwilling to provide insurance to at-risk individuals (especially those with pre-existing conditions such as HIV/AIDS, orphans, or other vulnerable populations), focus on in-patient and catastrophic coverage rather than routine and out-patient care, face high entry and administrative costs, lack qualified personnel, or have not designed products that can be delivered effectively to the target population.

Graph taken from 9th International Microinsurance Conference .

Fortunately, insurers are beginning to see possible benefits from entering the HMI marketplace. A huge percentage of insurable people are not currently included in the traditional insurance market (measurements go up to 96%); there is significant opportunity for providers to access this market and expand their product base.

The most popular mechanism for HMI delivery has been public-private partnerships. This method allows private insurers to access public sector data on large populations thereby broadening their market penetration and allowing them to design insurance products that best fit local needs. For example in Pakistan the organization Naya Jeevan offers HMI to low-income families along with health education, working with local schools and businesses to disseminate information and gain clients.[2] Micro Care Uganda offers HIV treatment, prevention, and counseling as part of their HMI packages.[3]

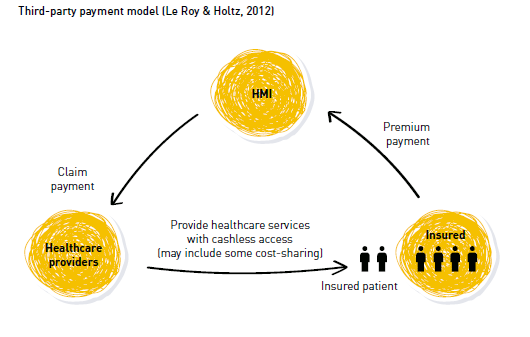

Diagram from Lessons Learned and Good Practices in Health Microinsurance.

Delivery mechanisms for HMI also vary widely and differ in complexity and accessibility. Within public-private partnerships three models are often utilized: the reimbursement model (clients pay healthcare provider directly for services and apply for reimbursement from the insurer); third-party payment (a third party pays for the healthcare services, patient pays premium and receives cashless medical care); and integrated care and financing model (benefits are embedded within existing healthcare facilities, client pays premium and is restricted to those facilities).[5]

Expansion of HMI programming will allow more at-risk and impoverished people to gain the healthcare they need. Overcoming the barriers to market penetration and ensuring high participation rates will be very important to insurers as HMI becomes more popular. If these barriers are overcome and delivery methods are enhanced, the future will see more people in developing countries with access to quality, reliable, and affordable health microinsurance.

[1] Microinsurance Network. (2013). 9th International Microinsurance Conference.

[3] Innovation for Sustainable Development: Local Case Studies from Africa, Microcare, Uganda: Financing Health through Communities

[4] Chandani, Taara. (2013). Lessons Learned and Good Practices in Health Microinsurance. Microinsurance Network.

[5] Chandani, Taara. (2013).