By Ardian Shaholli

Amid the inflation rate reaching a 40-year high, there is an understandable impetus for the Federal Reserve to take action. It has raised interest rates four times during the first seven months of this year, including two 0.75% rate hikes, the highest increase since 1994. Back in May of this year, Federal Reserve Chair Jerome Powell identified rising wages and low levels of unemployment as the biggest issues driving inflation. Former Clinton Administration Treasury Secretary Larry Summers reiterated that rising wages are a “super core” contributor to inflation.

These claims ignore the fact that the wages of American workers have remained stagnant for close to four decades. The 5.1% increase in private sector wages for 2022 is not particularly abnormal when accounting for a concomitant growth in productivity. Finally, a low unemployment rate of 3.7% is deceiving when acknowledging that the labor force participation rate has yet to recover to pre-pandemic levels.

The prognostications of Powell and Summers overlook how supply chain issues, war and corporate profits all contribute to inflation. Rampant rate hikes also disproportionately hurt those struggling to make ends meet.

Rate Hike Effects

*0.25% rate increase

**0.50% increase

***0.75% increase, highest since 1994

****0.75% increase

Notably, the inflation rate has stagnated — with occasional upticks — during the Federal Reserve’s four interest rate hikes. Interest rate hikes are a flat across-the-board increase on essential items and services. They are not targeted in a manner to ensure that those with the means to pay are proportionately hit with a higher rate— like a progressive income tax increase. This means the poorest among us are hurt the most by this decision. Banks and other lending institutions benefit the most from rate hikes since they receive larger interest payments from borrowers.

Credit cards, auto and home loans are all either directly or heavily influenced by the Federal Reserve’s interest rate decisions. Student loan borrowers will also be on the hook once the current pause on payments and interest accrual is lifted.

The average variable credit card interest rate reached 18.03% in August, hitting its highest rate of the year since June’s 16.1% interest rate. Amid the Federal Reserve’s four interest rate hikes, Americans opened an extra 233 million credit card accounts— the most since 2008. Credit card balances have, in turn, soared by $46 billion during this rate hike spree. This indicates that most households are in an economically precarious position and must heavily rely on credit card debt to make ends meet. Raising rates will exacerbate the pain inflicted upon the economically vulnerable.

Car loan payments are surging accordingly with Federal Reserve policy. The average monthly payment on a new car loan reached a zenith of $667 in August— a 15% increase from a year prior.

Home loans are also at their highest level since late 2008, with the average rate on a 30-year fixed-rate mortgage reaching 6.02%. Sure, this trend typically contributes to a cooling off of the housing market. Yet, housing prices continued to rise for the first half of this year. The rate hikes compounded a core cause of unaffordable housing, the lack of housing supply. Developers assume that prospective homebuyers will hold off on taking out a mortgage as rates rise. Therefore, as mortgage rates have risen, housing starts and permits have dropped to annual lows.

Supply Chain Issues

The Federal Reserve Bank of San Francisco estimates that supply chain problems account for over half of the inflationary pressure experienced in the United States. It is unclear how higher interest rates are supposed to ameliorate the global supply chain bottleneck.

Interest rate hikes are intended to deal with the demand side of the equation. The assumption is that households flush with cash will cause prices to soar. However, this assumption is untrue. Personal savings as a share of disposable income per household are lower for this year relative to pre-pandemic levels.

Importantly, many of the issues currently plaguing the supply chain are decades in the making. For example, the Motor Carrier Act of 1980 deregulated the long-haul trucking industry. Overtime, this led to a heavily unionized and sumptuously compensated industry becoming almost entirely composed of poorly paid independent contractors culminating in the all-time high trucker shortage of today.

Deregulation also contributed to the ocean shipping industry capitalizing on the pandemic’s supply chain woes. Throughout most of the 20th century, this industry was regulated as a public utility. While ocean carriers could coordinate on prices and routes, price and fee transparency was mandated. Additionally, secretive deals favoring specific regions or providing discounts for greater shipping volume per container were prohibited. The Ocean Shipping Reform Act of 1998 upended this dynamic. It authorized making rates and shipping deals between carriers and exporters proprietary. Thus, the top ten ocean carriers currently control 80% of the market— accounting for over twice as much market share as they did in 1998. As carriers have jacked-up rates and built bigger ships that cannot dock in smaller ports – exporters have fewer options and must acquiese to higher rates. Accordingly, in the third quarter of 2021, the industry’s new profits reached a record high, accounting for 42% of gross revenues.

The Effect of War On Food & Fuel

The World Bank projects that energy prices will increase by 50% over the course of the year due to production disruption caused by Russia’s invasion of Ukraine and subsequent economic actions on the part of the United States and Europe. From June 2019 to June 2022, natural gas, gasoline, and oil prices have increased by 135%, 88%, and 81% respectively. Globally, food prices remained 14.8% higher in August 2022 relative to August 2021. Production and agricultural disruptions ignited by Russia’s invasion of Ukraine are the main catalysts for this trend – especially since these two nations account for one-third of global barley and wheat production and 70% of sunflower oil production.

Out of June’s 9.1% increase in the consumer price index, over one-third was attributable to food and energy prices alone. Therefore, until this conflict is resolved, fuel and food prices will continue their volatile trajectories, regardless of the Federal Reserve’s interest rate policy.

Record Corporate Profits & CEO Compensation

US corporate profits reached their highest levels since 1950 last month. Corporations purchased their own stock—a practice known as stock buybacks— at record levels in fiscal year 2022’s first quarter. This practice inflates share price by reducing the supply of outstanding shares. Thus, as company ownership is consolidated, the remaining shareholders’ dividend payments skyrocket.

Why invest in research and development or workers when you can give yourself more money as a reward for consistently giving yourself more money?

While many are feeling the pinch of inflation, CEOs are not. In 2021, the executives of the United States’ 400 largest companies set a sixth-straight annual median pay record of $14.7 million. Consequently, the CEO-to-median worker pay-gap ratio soared to a record 670-to-1 among the nation’s 300 largest firms.

Wall Street’s insatiable lust for record profits amid various global tragedies is felt everywhere. For example, in March, nearly 60% of oil executives reported a refusal to drill for oil out of fear of upsetting energy investors. The easing of pandemic restrictions increased demand for oil, while Russia’s invasion of Ukraine diminished supply. Investors capitalized on this dynamic, leading to record oil prices in March—the single largest annual hike in oil prices since 2008.

Do not fret, oil companies enjoyed record profits in July as a reward for adhering to investor edicts.

Corporate Profits & Price Increases

Assertions that higher wages or robust employment levels are responsible for inflation have historically never been as absurd as they are now.

Three variables predominantly determine the price of a good or service. Corporate profits, nonlabor input costs (i.e., land, equipment, raw materials, etc.), and unit labor costs (the amount firms must pay workers to produce one unit of output).

Between 1979-2019, unit labor costs contributed disproportionately to the growth in prices on average – accounting for 61.8% of the total increase. Nonlabor input costs and corporate profits contributed 26.8% and 11.4%, respectively.

However, amid record profits, a fundamental shift occurred in the second quarter of 2020. Between Q2 2020 and Q4 2021, corporate profits accounted for 53.9% of the total increase in prices. The share attributable to nonlabor input costs and unit labor costs dropped to 38.3% and 7.9%, respectively.

As corporate concentration of the economy intensifies, businesses have realized that they can have their cake and eat it too. Higher prices lead to bigger profits. Bigger profits lead to greater market share. A greater market share leads to consumers being forced to buy more expensive goods since increasingly fewer alternatives exist. This trend is corroborated by the findings from a recent analysis conducted by the Federal Reserve Bank of Boston. The study discovered that between 2005-2020 industry concentration grew by 50%, contributing to a 25% increase in prices paid by consumers.

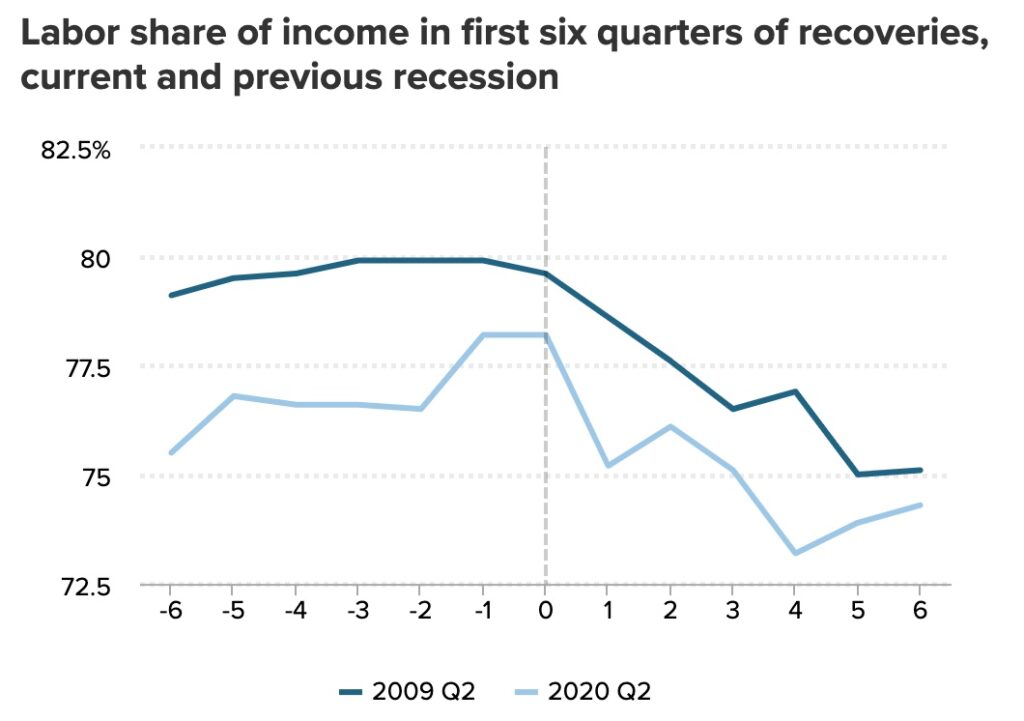

Moreover, the labor share of income remains at a lower level for six quarters following the 2020 recession relative to the same timeframe after the 2008 recession. Notably, the 2008 recession occurred during a historic deflationary period. Therefore, the notion that today’s inflationary pressures are mainly spurred by wages of workers that account for an even smaller share of total income is ridiculous.

Unfortunately, these deleterious effects are likely to persist. While inflation is a serious concern, interest rate hikes have and will continue to compound the hardships it inflicts upon workers. As Federal Reserve Chair Powell motions to raise interest rates again this month, we shall get a notion of this move’s efficacy when the next batch of inflation numbers for September are released on Oct. 13