Highlights

- Affordable housing strike funds provide flexible, below-market financing to fund the preservation of existing affordable multifamily housing by utilizing a combination of public, private, and philanthropic dollars.

- Requiresignificantpublicinvestmentaswellasstronginterestfromfoundationstoseedthefund

- Large start-up costs and complex administration

Action Steps to Get Started

- Secure seed funding to cover start-up costs.

- Create a coalition of government agencies, foundations, lenders, and other stakeholders to identify funding opportunities.

The Problem

Across Texas, thousands of affordable multifamily units are disappearing as they are redeveloped as higher-end housing or commercial properties. These disappearing units include government-subsidized properties as well as unsubsidized “naturally occurring” affordable properties. Affordable units in gentrifying neighborhoods are especially vulnerable to redevelopment pressures. Preserving these existing affordable units is typically one-half to two-thirds as expensive as constructing new affordable rental housing as well as more environmentally sustainable. Cities and affordable housing providers face many challenges in preserving these units. Acquiring affordable multifamily properties in hot markets, where preservation organizations may be competing with cash buyers, often requires quick and nimble access to financing, which purely private capital and public loan programs typically cannot provide.

The Tool: Affordable Housing Strike Funds

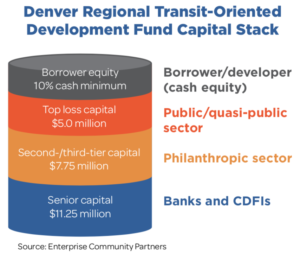

To advance the preservation of at-risk affordable multifamily properties and close these financing barriers, a number of cities around the country have formed public-private partnerships to create below-market debt funds. These funds, also referred to as “strike funds,” or “layered funds,” offer low-cost loans to affordable housing developers and other entities to purchase and preserve existing affordable multifamily housing. The funds are capitalized by layering public, private, and foundation funds. The government and foundation capital allow for loans with lower interest rates. Enterprise Community Partners and the Local Initiatives Support Corporation have been partners in several strike funds around the country.

These funds are typically “revolving,” meaning that as the loans are repaid, new loans can be made. The loans are typically five to seven years, at which time the properties are refinanced with other loans or subsidies, such as federal Low Income Housing Tax Credits. Successful utilization of financing through a below-market debt fund depends on the availability of permanent financing from other sources at the end of the fund’s loan term. Below-market debt funds are most viable in markets with a high-capacity city housing department and where there is strong interest from the philanthropic community.

Private-Only Funds

Some strike funds have started that rely largely or solely on private investments. These funds vary in their commitment to long-term affordability and often lack transparency in structure and returns. While income targeting varies, most of these funds are labelled as preserving “workforce housing” and are aimed at higher income levels than those served by funds that utilize a mix of public and private sources.

Examples of Public-Private Strike Funds

Los Angeles’s New Generation Fund was formed in 2008 to offer pre-development, acquisition, and moderate- rehab financing through a private-public partnership with the city and a consortium of private and community development financial institutions. The District of Columbia’s newer Public-Private Affordable Housing Preservation Fund was seeded with an initial $10 million in local funds, with a goal of leveraging an additional $70 million in funding for short-term bridge acquisition and pre-development financing.

Successful funds focused on preservation of affordable rental housing near transit have been created in the Bay Area and Denver. The Denver Regional Transit-Oriented Development Fund and The Bay Area Transit-Oriented Affordable Housing Fund began with $10 million to $13.5 million in capital from public agencies, later expanding to include equity from banks, community development financial institutions, and foundations.

Additional Examples

Chicago Opportunity Investment Fund, Seattle Regional Equitable Development Initiative Fund, New York City Acquisition Fund, Invest Atlanta TOD Fund

Resources

Preserving Multifamily Workforce and Affordable Housing (Urban Land Institute), Funds for Kickstarting Affordable Housing and Preservation (Federal Reserve Bank of San Francisco)