Highlights

- Provides tenants and cities with the right to purchase government-assisted multifamily rental properties and mobile home parks when the owner decides to sell the property or exit the affordable housing program

- Powerful tool for minimizing tenant displacement and creating rare low-income homeownership opportunities in gentrifying neighborhoods

Action Steps to Get Started

- Adopt city and tenant right-to-purchase and notice ordinance.

- Secure funding to support tenant organizing and capacity building for tenant associations and nonprofit preservation organizations or partner with national or local organizations that already have that capacity.

- Secure funding to help fund the acquisition and rehab of at-risk multifamily buildings and mobile home parks (see the Affordable Housing Strike Fund tool for one successful approach).

Overview

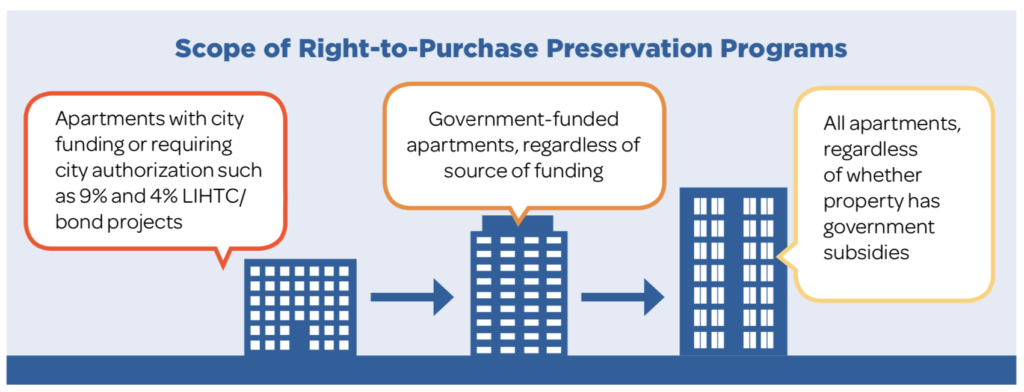

Right-to-purchase ordinances provide cities, tenants, or both with advanced notice and rights to purchase a multifamily rental property when the owner decides to sell the property, exit the affordable housing program, or convert the rents to market rate. These purchase rights can extend to: (1) all government-assisted apartments with city funding or requiring city approval to be funded (such as 4% LIHTC/tax-exempt bond projects in Texas); (2) all government-assisted apartments, regardless of the source of funding; or (3) all apartments, regardless of whether the property has received government subsidies. Some purchase rights are structured as purchase options, which give the city or tenant association the option of purchasing an affordable apartment complex at the property’s appraised value upon certain triggering events, such as when the owner is seeking to exit the federal Low Income Housing Tax Credit program. Other rights are structured as rights of first refusal, which are triggered when the owner chooses to sell the property, and which allow the city or tenants to match the price offered by the third-party purchaser. Right-to-purchase laws typically give the city and tenants the right to assign their rights to a nonprofit preservation organization.

Denver’s Right-to-Purchase Ordinance

As an example, the City of Denver’s ordinance, adopted in 2015, applies to all government-assisted multifamily rental properties, regardless of the source of public funding, such as Project-Based Section 8 and Low Income Housing Tax Credit properties. For federally-subsidized properties, the ordinance requires owners to provide (1) one year’s advanced notice to the city and each tenant of the owner’s intent to opt out of the affordable housing program, and (2) 90 days’ advanced notice of the owner’s intent to sell the property. The notice requirement for city-funded properties is 90 days. If the owner enters into a purchase and sale agreement, the owner must provide a right of first refusal to the city or its designee to purchase the property. The city has 120 days to decide whether to exercise the ROFR and then another 120 days to close on the purchase.

The Washington, D.C. Model

Washington, D.C., operates the most robust and successful right-to-purchase program in the country, through the District’s Tenant Opportunity to Purchase Act (TOPA) and District Opportunity to Purchase Act (DOPA). TOPA gives tenants or their designee the priority opportunity to purchase a building when a landlord plans to put it on the market, while DOPA gives the city the right to purchase the property if the tenants do not exercise their right. TOPA and DOPA have been two of the District’s most powerful tools for preserving affordable multifamily housing in a hot real estate market.

When tenants in D.C. exercise their purchase right, they can transfer their right to a third party, such as a nonprofit housing organization, or purchase their building and retain ownership. For low-income tenants, ownership is typically structured through the creation of a limited equity cooperative, where residents collectively own their building but with resale restrictions to preserve the long-term affordability of the units. The initial purchase price of a limited equity co-op unit is typically very low, and many of the limited equity co-ops in D.C. end up affordable to households making less than 50 percent of the area median income, with some purchase prices even affordable for households making less than 30 percent of the area median income.

Mobile Home Park Purchase Rights

Mobile home park purchase rights have likewise been successful around the country in preserving affordable housing. These ordinances provide mobile home park residents with a right of first refusal if the owner chooses to sell the park. As in the case of purchasing a multifamily building, the successful acquisition of a mobile home park by tenants requires funding for resident organizing and technical assistance. Fortunately, loan financing is already available through organizations like ROC USA, a national nonprofit social venture with a proven track record of financing resident ownership of mobile home communities. ROC USA has already financed at least one mobile home resident ownership project in Texas (Pasadena Trails). Around the country, there are many examples of successful resident acquisitions of mobile home parks that are providing a long-term source of stable affordable housing for low-income residents.

Keys to Successful Implementation

To be successful, a right-to-purchase ordinance for tenants needs to be paired with significant financial support for the acquisitions, technical assistance, and capacity building support. The preservation strike fund tool discussed in this toolkit can provide an important source of financing to assist with acquisition costs. Ideally a right-to-purchase ordinance would also be coupled with a preservation database and network (also discussed in the toolkit) to closely monitor opportunities for purchases. Close attention must be paid upfront in drafting the ordinance to address potential legal loopholes.

Examples

Washington, D.C. (District Opportunity to Purchase Act and Tenant Opportunity to Purchase Act, covers all multifamily rental properties); Denver (subsidized multifamily rental properties); Massachusetts (purchase option for subsidized multifamily properties); New York City (NYC Admin Code, Section 26-802 to 806, subsidized multifamily rental properties); Maryland (subsidized multifamily rental properties). A number of states provide a right of first refusal for mobile home park sales, including New York State, Minnesota, and Florida.