Highlights

- CLTs provide opportunities for current and future generations of low-income residents to own

homes in a gentrifying neighborhood, while giving communities long-term control over the

land.

- CLTs can qualify for significant property tax savings in Texas.

- CLTs can be an unfamiliar concept to many residents; garnering community support for a CLT may require extensive education and community trust building.

Action Steps to Get Started

- Conduct extensive community education and outreach about the CLT model; engage community in the development of the CLT.

- Designate or create an entity with capacity to operate a CLT.

- Allocate subsidies to support land acquisition, construction of CLT homes, and initial operational costs.

- Create a city ordinance adopting the CLT property tax exemption and designate one or more local CLTs under Chapter 373B of the Texas Local Government Code.

How a CLT Works

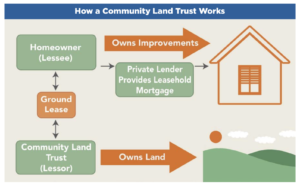

In a community land trust, a nonprofit organization maintains long-term ownership of land while using the land for a range of community benefits, such as selling and renting affordable homes on the land to low-income households and green space. Community land trusts typically incorporate residents into the governance of the CLT. A community land trust can be used with single-family housing as well as mixed-used and multifamily development, and with homeownership as well as rental housing.

For homeownership units, the CLT’s land is typically leased for 99 years to an income-eligible family for an affordable price ($25-$50 a month is common) through a very detailed ground lease, which sets forth the policies and rules governing the use and sale of the property. An income-eligible family purchases the home sitting on the land at an affordable price with mortgage financing, typically from a bank.

When the family wishes to sell the home, the nonprofit CLT typically has a right of first refusal to purchase the home, and the resale price is restricted to ensure the home can be resold at an affordable price to another low-income buyer. CLT homeowners recoup what they paid for the home, while a fixed rate of appreciation caps the amount of appreciation they can receive if property values are rising. For rental CLT units, the nonprofit entity maintains ownership of the home and leases it to an income-eligible family for an affordable price.

After gentrification intensified in the Guadalupe neighborhood of East Austin, several affordable homes sold by Guadalupe Neighborhood Development Corporation (GNDC) resold at market prices far exceeding what a low-income family could afford. Today, GNDC’s leaders regret that they did not utilize stronger affordability protections in those earlier home sales, and the organization now uses the community land trust model exclusively for its homeownership units.

CLT Goals

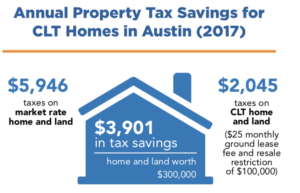

- CLTs provide a source of permanently affordable homeownership and rental housing for current and future generations of low-income families, even amidst rapidly rising land values. CLTs protect precious public investments in affordable housing by taking land out of the speculative real estate market. In Texas, through tax breaks available in Chapters 11.1827 and 23.21 of the Texas Tax Code, qualified CLTs and CLT homeowners are eligible for substantial property tax savings. For example, a CLT home and land worth $300,000 in Austin results in annual tax savings of close to $4,000.

- Through long-term community control of land, the CLT structure gives communities the opportunity to shape future redevelopment in the neighborhood and preserve the cultural legacy of a community. For example, the Guadalupe Neighborhood Development Corporation’s “four corners strategy” of acquiring as many lots as possible on each block corner of the Guadalupe Neighborhood in Austin has protected a large part of the neighborhood against further commercial encroachment from downtown.

- CLTs support the stability of homeowners and renters participating in the CLT. A CLT serves as an active steward to help ensure families are able to hold onto their homes. The ground lease provides a mechanism for the CLT to guard against predatory loans on the home and ward against foreclosures. Many CLTs charge a minor monthly stewardship fee to help with long-term maintenance of the homes.

- The unique CLT structure, by severing ownership of the land from the home, as well as the property tax savings that come with this model in Texas, enables communities to provide more deeply affordable homes serving lower-income families who would otherwise be unable to afford their own home. CLTs can also be structured to help low-income families in financial distress remain in their current homes. For example, the City of Lakes CLT in Minnesota is working to help current homeowners in financial crisis stay in their homes by transferring ownership of the land into the CLT in exchange for the family receiving assistance to rehab their home and pay off their tax debts.

A CLT should be created only if there is clear community support for this model. Extensive community engagement and securing the trust of the community is critical to a CLT’s success. Community control of land can be an unfamiliar concept to many residents and often requires extensive education and community trust building to counter suspicions of a land grab. If these steps are not taken, a community may ultimately oppose efforts to create the CLT.

To be successful, CLTs also need access to land. Public land, such as surplus land and city land bank lots, can be an excellent resource in many cities to help CLTs get off the ground. CLTs may also need grant funding to help subsidize the construction of the houses as well as cover operational costs in the initial stages of the CLT’s development.

Questions to Answer Before Forming a CLT

- Can an existing organization successfully take on the functions of a CLT– including long-term stewardship of CLT properties–or does a new organization need to be created?

- What types of partnerships are needed to ensure the success of the CLT, such as construction of the homes and assisting families with qualifying for mortgages?

- What roles will the CLT homeowners and renters as well as other community residents play in the creation and governance of the CLT? Traditionally, CLTs have included active roles for CLT residents.

- On what scale will the CLT operate? Historically, CLTs have been operated on a neighborhood scale to provide for long-term community control of land and permanent affordability, but several CLTs, such as the City of Houston’s new CLT, operate citywide.

Texas Examples

- Austin: The first CLT in Texas was created by the Guadalupe Neighborhood Corporation in 2012. Through its CLT, GNDC has successfully created a legacy of permanently affordable housing under long-term community control in a rapidly gentrifying area where market rate homes now sell for over $750,000.

- Houston: The Houston Community Land Trust was created in 2018 by the City of Houston as an independent nonprofit corporation. The Houston CLT is utilizing Houston’s land bank lots for construction of new homes for families at 80% AMI and below, with prices starting at $75,000.

Other Examples

There are more than 240 CLTs in 46 states, including North Carolina (Community Home Trust, Durham Community Land Trustees); Chicago (Chicago Community Land Trust); and Albuquerque (Sawmill Community Land Trust).

Resources

- A Guide for Developing Community Land Trust Affordable Homeownership Programs in Texas (Eliza Platts- Mills, Univ. of TX School of Law);

- Grounded Solutions Network