Highlights

- Relatively low-cost solution to help vulnerable homeowners qualify for valuable homestead

exemptions and pay their property taxes

- Texas Senate Bill 1943 (enacted in 2019) improves heirs property owners’ access to

homestead exemptions, but community education and assistance is needed to help them

qualify.

Action Steps to Get Started

- Designate a nonprofit entity or city department to operate one or more centers.

- Allocate operational funding.

The Problem

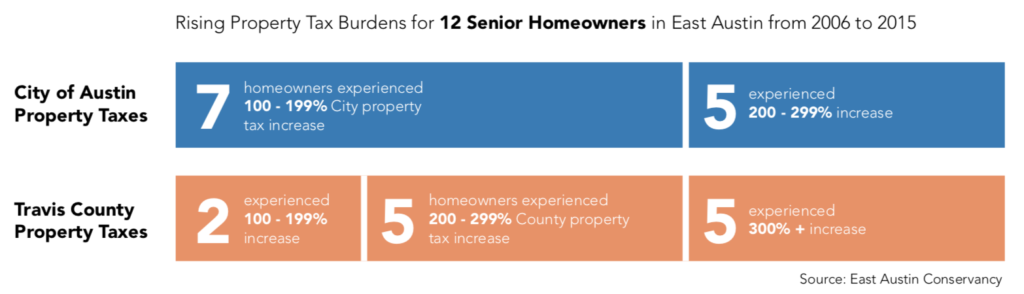

As a neighborhood gentrifies, low-income homeowners face recurring property tax increases, which can lead to mounting financial pressures and, ultimately, loss of their homes. In Austin, for example, the highest percentage of homeowners who are two or more years behind on their property taxes are located in Austin’s fastest gentrifying neighborhoods. One-third of these homeowners are seniors.

In Texas, a homestead exemption brings several important forms of tax relief to help homeowners stay in their homes, especially for seniors, disabled veterans, and other persons with disabilities. These forms of tax relief include various reductions from the appraised value and tax deferral rights for certain groups of homeowners.

Despite these important protections, many low-income homeowners who are eligible for a homestead exemption in Texas, especially heirs property owners, do not have one. An heirs property owner is someone who inherited their home from a relative after the relative died intestate (i.e., without a will). Heirs property is a common form of ownership in older gentrifying neighborhoods. Texas legislation passed in 2019 (Senate Bill 1943) improves heirs property owners’ access to homestead exemptions, but many owners need to submit new paperwork with the local appraisal district to qualify for these expanded rights. Community education and targeted assistance is needed to help ensure these homeowners and others take advantage of homestead exemptions and stay current on their taxes.

The Tool: Homestead Preservation Centers

Homestead Preservation Centers could be created in Texas cities to provide targeted assistance to heirs property owners and other vulnerable households in gentrifying neighborhoods to make sure they access the homestead exemption benefits they are eligible for and do not fall behind on their property taxes. A center could be operated by the city or community partners in a gentrifying neighborhood and funded by the city, foundations, or both. The center could obtain lists from the appraisal district and tax assessor of likely homeowners without an exemption or with property tax delinquencies and then provide targeted, door-to-door outreach to these homeowners to assist them with enrolling for homestead exemptions, financial counseling, and assistance negotiating payment plans with the tax assessor-collector. Community institutions trusted by residents could be brought in as partners in the outreach.

A Homestead Preservation Center could also provide emergency grants and low interest loans to help a family overcome a financial crisis in order to catch up on their tax payments. Short of creating a center, Texas cities could provide funding to one or more community-based nonprofits who work directly with low-income homeowners, such as Meals on Wheels, to deliver homestead exemption enrollment assistance to families they work with.

Examples from Around the Country

A number of cities provide services targeted towards helping vulnerable residents with financial stability and holding onto their homes. None of these programs include the exact same scope as the Homestead Preservation Center discussed here, but they have different components that would be useful for Texas cities to consider.

For example, Cleveland’s Empowering and Strengthening Ohio’s People (ESOP) Program specializes in providing aging residents with financial stability. In 2014, the organization launched a Senior Financial Empowerment Initiative, which provides one-on-one financial counseling, financial education workshops, and foreclosure prevention assistance to seniors. ESOP’s Senior Property Tax Loan program provides property tax loans to seniors of up to $6,500, coupled with comprehensive financial counseling and ongoing financial coaching.

Pennsylvania’s Affordable Housing Centers offer a number of services related to supporting homeownership by low-income families, including a foreclosure counseling program, which helps homeowners who are struggling to make their mortgage or property tax payments. New York City’s Financial Empowerment Centers, with 20 neighborhood locations, provide financial education and counseling to help tackle debt, budgeting, and other financial stabilization services.

Examples

Cleveland (ESOP), Oregon (Homeownership Stabilization Initiative), Pennsylvania (Affordable Housing Centers of Pennsylvania), New York (New York City Financial Empowerment Centers)