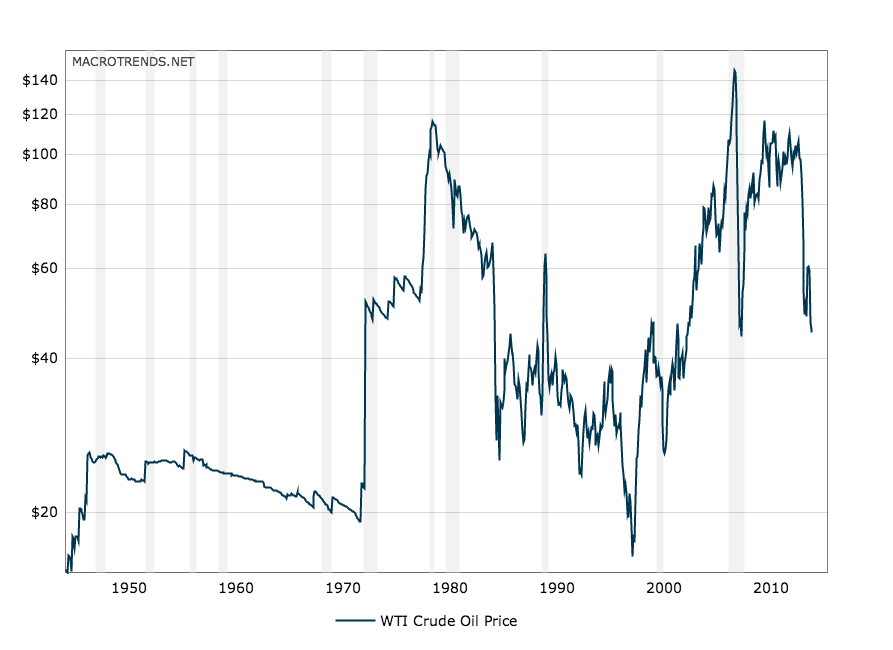

Since early August of 2014, oil that many presumed was permanently 100 dollars or more a barrel has plummeted as low as 38 dollars in September and a recent forecast advises it may go as low as 20 dollars.

Texas like Mexico has an economy heavily dependent on the extraction and sale of natural resources. For both the key resource is oil and gas. By 1970 Texas had pumped most of its readily available oil and began to have costs at the wellhead of about 10 dollars. That accounted for Texas’s last deep economic decline in the 1980’s when the Saudis angry at other OPEC and non-OPEC production rates drove the price of oil below 10 dollars. Indeed much of the economic history of Texas derives from the price of oil.

Two recent Texas Governors, George Bush and Rick Perry touted the growth of the Texas economy and attributed that to their leadership. Bush only got a slight bump from rising oil prices late in his administration, but Perry’s benefited from rising prices until the end, a full 14 years. Now with the slide in oil, so too has Perry’s slide begun as he withdraws from the Presidential race for 2016. Oil at 20 dollars for any length of time, a year or more will cause huge negative repercussion in the Texas economy. Unemployment will skyrocket in the West Texas towns of the Permian Basin, particularly Midland and Odessa. The larger oil shale plays near Ft. Worth and south of San Antonio are already slowing down as are the local economies. Houston, the state’s largest city, is seeing rising unemployment in the gas and oil industries. As the Texas economy slows, the tension with Mexican immigrants will rise even as Mexico like Texas has an economy highly dependent on the price of oil. News reports in Texas are beginning to document dropping incomes associated with oil.

Oil at 20 dollars for any length of time, a year or more will cause huge negative repercussion in the Texas economy. Unemployment will skyrocket in the West Texas towns of the Permian Basin, particularly Midland and Odessa. The larger oil shale plays near Ft. Worth and south of San Antonio are already slowing down as are the local economies. Houston, the state’s largest city, is seeing rising unemployment in the gas and oil industries. As the Texas economy slows, the tension with Mexican immigrants will rise even as Mexico like Texas has an economy highly dependent on the price of oil. News reports in Texas are beginning to document dropping incomes associated with oil.

The chart below shows how radical a drop, oil at 20 dollars is. The longer term pattern of oil’s price is complex. By 1970 all of the cheap oil in the world had been identified and has now been pumped. That is the central topic of the concept of “peak oil”. Over the next several decades the oil that comes to market will be more expensive to find and pump. However if alternative enegy sources such as solar and fusion develop, we may be seeing the ending days of “King Oil”.

Very good blog, thank you for the contribution