Yesterday’s Brexit vote was widely seen as a referendum on referenda. The populist right across Europe now routinely is demanding to take issues directly to the people in order to bypass the parliamentary process which has not produced desired outcome–a process The Economist recently dubbed Referendumania. The United Kingdom Independence Party (UKIP) has demanded for years that important issues like EU membership should be voted on by the electorate. Prime Minister David Cameron gave in to the demands in order to win the last election, feeling confident that he would win the vote and thus quiet the right-wing opposition. The gamble backfired: Cameron lost both the vote and his job.

The price Britain will pay for playing with the populist fire is potentially steep. Scotland voted overwhelmingly in favor of staying in the EU and now wants a second vote on independence. In Northern Ireland, the vote opened up old confessional lines of cleavage: Protestant Unionists voted for the Brexit, Catholics against. And the City of London may lose its position as premier financial market in Europe. Most importantly, the British economy will face an uncertain future. The EU is unlikely to sign off on free trade arrangements of the sort Norway and Switzerland enjoy because such a deal would encourage other member nations to leave as well. Furthermore, it took Switzerland a couple of decades to arrive at its current, admittedly cushy relationship with the EU.

Governments in other European countries no doubt will try to avoid this populist trap. This will enrage the masses even more, and demands for more democracy will become ever louder. In the wake of the British vote, the German right-wing party Alternative for Germany (AfD) has demanded more direct democracy for Germany. Marine Le Pen, the leader of the Front National, promised a referendum on the Frexit if she is elected president of France next year. And the Dutch right-wing leader Geert Wilders announced a push for the Nexit.

One real concern is that this type of referendum is susceptible to lies and deception. The Brexit campaign was run entirely as a post-truth campaign. Its most visible element was the Vote Exit campaign bus run by Boris Johnson, the former mayor of London and possible successor as prime minister. The inscription on the side of the bus made a bold claim: “We send the EU £350m a week.”

As it turns out, the figure is wrong. It disregards the massive rebate Britain has received since 1985, and it does not include the EU payments that flow back to British institutions. But facts just did not matter in this campaign that was ruled by anger and fear and dominated by issues like immigration and sovereignty. Michael Gove, co-chair of the Leave campaign and current minister of justice, was asked to name a single independent economic authority who thought Brexit was a good idea. His response: “I think people in this country have had enough of experts.”

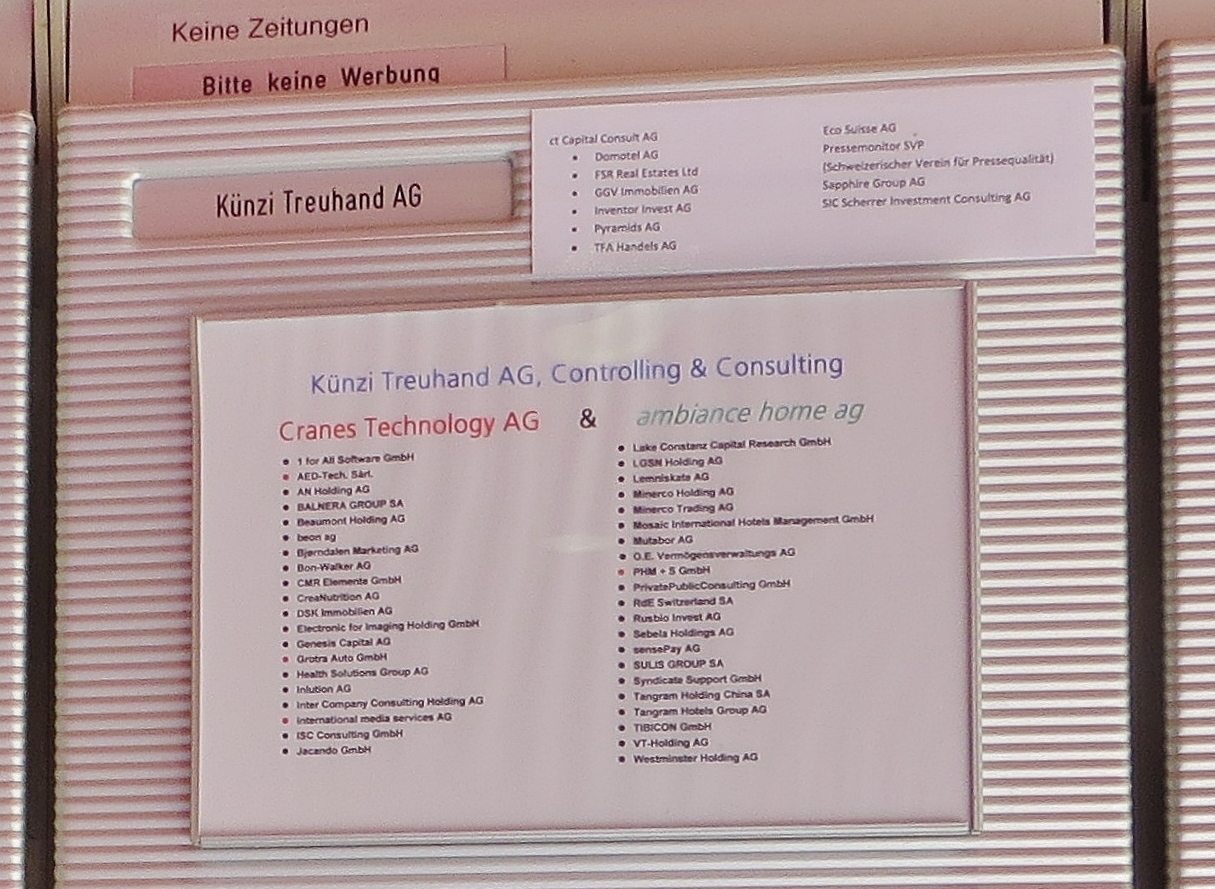

The counter-example to this narrative is Switzerland. Swiss voters go to the ballot box four times a year to decide three or four issues each time. Direct democracy in Switzerland has grown organically into the fabric of Swiss politics since the late 19th century. Both the government and the media generally do a good job to inform the public on the facts and on the pros and cons of the issues to be voted on. As a result, Switzerland has developed a polity that is structured from the bottom up and that allows voters to participate in decision-making processes on all levels of government. This system has produced an educated and knowledgeable electorate that is much less likely to be fooled by deceptive populist rhetoric.

Political systems create political cultures as much as political cultures shape political systems. Countries like Britain and Germany have a strong tradition of parliamentary democracy. Voters elect leaders who represent them in parliament that in turns forms a government which it controls. This mechanism does not really allow for an alternate decision-making process, for instance in the form of a referendum, as the political culture does not have the tools to deal with it. A system that works exceedingly well in Switzerland therefore could turn toxic for Britain, with the potential of doing the same in other European countries.

There are two reasons why the current populist anger is directed at the European Union and why referenda could accelerate the unraveling of the EU. The European Union has been an elite project. It has done a poor job explaining to Europeans how it has brought peace and prosperity to a continent that had been ravaged by two world wars, how it helped Spain, Portugal and Greece transition away from fascist dictatorships, and how it supported countries formerly in the Soviet bloc both politically and economically. But it also created institutions that are not transparent and that delegate too many decisions to bureaucrats in Brussels. And it has thoroughly mismanaged the Greek debt crisis. Thus it has become an easy target for malcontents.

The second reason is that Globalization has contributed to the de-industrialization of Western Europe (as well as North America). This has created massive wage stagnation and chronic unemployment among the working classes, and it has spawned unprecedented levels of global migration. European populists successfully managed to blame the European Union for both. In reality, 1.5 billion workers, mostly in China and India, have joined the global labor market over the past quarter century which has created extraordinary pressures. On top of that, the digital revolution has begun to make human labor redundant–a trend that may lead to massive unemployment in developed societies in the future. The EU is responsible for none of this: British voters will soon discover that leaving the EU will not lessen the competitive pressures on British industry, nor will it ease migration pressures.

Western democracies have become vulnerable to populist deception. Boris Johnson will be rewarded for his deceptive politics by inheriting the job of Prime Minister. He also wrote the playbook for Donald Trump on how to win a fact-free campaign that is not restrained by the limitations of truth. Maurine Le Pen is favored to win the French presidency next year. And Angela Merkel, the lone beacon of reason in European politics, may well stumble over the populist furor raised by the refugee crisis. Direct democracy which has given Switzerland unparalleled political stability and economic success may also become the political idea that will give the populist right the tools to undo the European Union.