In the last post on this subject—RFS: Reconsidering Fuel Standards? —the possibility of new alternative fuels emerging that can compete with fossil fuels was briefly introduced. Due to the controversy surrounding renewable fuel standards, specifically whether they drive up food prices and the “blend wall” that limits the proportion of ethanol that can be mixed with gasoline for use in most spark ignition internal combustion engines, the argument for reconsidering renewable fuel standards and opening up possibilities for emerging alternative fuels to compete is a strong one. By requiring displacement of a proportion of fossil fuels instead of mandating blending specific volumes of particular renewable fuels, the field of alternative fuels will open to all contenders, and alternative fuel R&D investment will be incentivized. An alternative fuel standard would prove to be more flexible and beneficial than rigid renewable fuel mandates currently being used.

China and Methanol

According to a Real Clear Energy article, China currently leads the world in Methanol production, producing about 25% of the global supply. “The Chinese have been growing their methanol industry since the U.S. interested them in the 1990s. China now has a million methanol cars on the road, whereas the U.S. only got as far as 15,000 cars in California before calling off the experiment in 2003.” Ironically, China may be much better prepared for incorporating new CO2 to methanol conversion technologies than the United States. After all, “…the Environmental Protection Agency hasn’t yet approved methanol in car engines – even though it is mandating ethanol, which many people regard as an inferior product.”

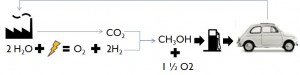

According to a recent Fuel Freedom blog post, Chinese policymakers considered mandating the blending of at least 15% methanol in gasoline, but initially experienced resistance from executives in the oil industry. While this obstacle may no longer prevent China from requiring the blending of methanol with gasoline, fuel stations have already been blending methanol with gasoline in China for some time. In fact, because it is not yet legalized and standardized, fuel sellers make additional revenue by cutting down gasoline with methanol and selling it as regular gasoline. This is because methanol sells for about half the price of gasoline in China. If China ramped up its methanol production capacity further by using new CO2 to methanol technologies, the dream of capturing carbon from Chinese coal plants may actually become realistic. In fact, it is possible that investments in carbon capture may produce a net savings. Carbon Recycling International is currently operating a commercial scale CO2 to methanol plant in Iceland, which operates using geothermal energy and produces methanol at a cost lower than the market price of gasoline.

Can the U.S. Catch Up?

According to a recent blog post on Fuel Fix, a Dutch fertilizer company announced plans to construct the largest methanol production plant in the United States, in Beaumont, TX. Methanol has a wide range of applications other than as a possible transport fuel, and can be made from natural gas. As the blog post indicates, methanol can work alongside corn-based ethanol to displace even more gasoline made from imported oil. Nassef Sawiris, CEO of the company building the plant, said “Since natural gas is currently cheap in the United States, methanol added to a gallon of gasoline would lower pump prices for consumers…methanol could be added to gasoline at the price equivalent of about $2 a gallon, displacing more expensive gasoline made from oil.” If methanol made from valuable natural gas can be produced for $2 per gallon, it is possible that using other methanol production methods, like the CO2 to methanol process, could be even more economical.

With several other large-scale methanol production plants being planned along the Gulf Coast, it is clear that methanol producers are following the lure of low-cost natural gas. Sawaris said that “…the methanol plant will be viable, even if natural gas prices rise significantly. But it will be dependent on demand for methanol, which currently sells for about $500 per ton.” Despite the pilot project in California, in cooperation with China on methanol-fuelled vehicles, methanol is still not approved for use in gasoline engines in the U.S. Opening up the transport fuel market to competition from methanol would lower fuel costs for drivers and reduce transport greenhouse gas emissions, whether the methanol is made from natural gas or captured CO2.

As policymakers in the United States debate the future of the Renewable Fuel Standard, they should recognize the potential of emerging alternative fuels. By opening up the restrictive policies that mandate the use of specific quantities of particular fuels, the U.S. can reduce the GHG emissions of its transport sector while reducing oil imports. Ethanol producers may not want to compete against newcomers, but if methanol lives up to its potential as a clean transport fuel that can easily compete with gasoline, it is in the interest of the U.S. to let the best alternative fuel rise to the top.